Laws.com's legal forms guide explains that a DD Form 200 is a Department of Defense form used for investigating financial liability resulting from the loss of Department of Defense property. Its main purpose is to determine the financial charges for equipment or items that have been lost, damaged, or destroyed. The DD Form 200 can be obtained from the Department of Defense documentation website or through the chain of command. The investigating official needs to fill out the basic information about the investigation that the form will cover. This includes indicating the date the investigation is initiated and the investigation number. Sections three to ten of the form are used to provide information about the lost property. In these sections, you must indicate the date of loss, the national stock number, a description of the property, the quantity, and the costs. Section nine is used to describe how the property was lost. It is recommended to attach a corresponding narrative to provide a detailed explanation of the circumstances surrounding the loss. Section ten is used to outline the actions that will be taken as a result of the loss. Again, it is advised to provide a narrative elaborating on the future action. The individual conducting the investigation must provide their information in section eleven and certify the form with their signature. The responsible officer or reviewing authority must also be identified in section eleven, with the proper authorizing signature attached. If there are any appointing or approving authorities, they should fill out sections thirteen and fourteen, providing additional comments about the property loss. It may be necessary to attach additional sheets for each authority to provide reports of the event and future recommendations. Section fifteen is for the financial liability officer to complete. This officer will supply their report on the loss of property,...

Award-winning PDF software

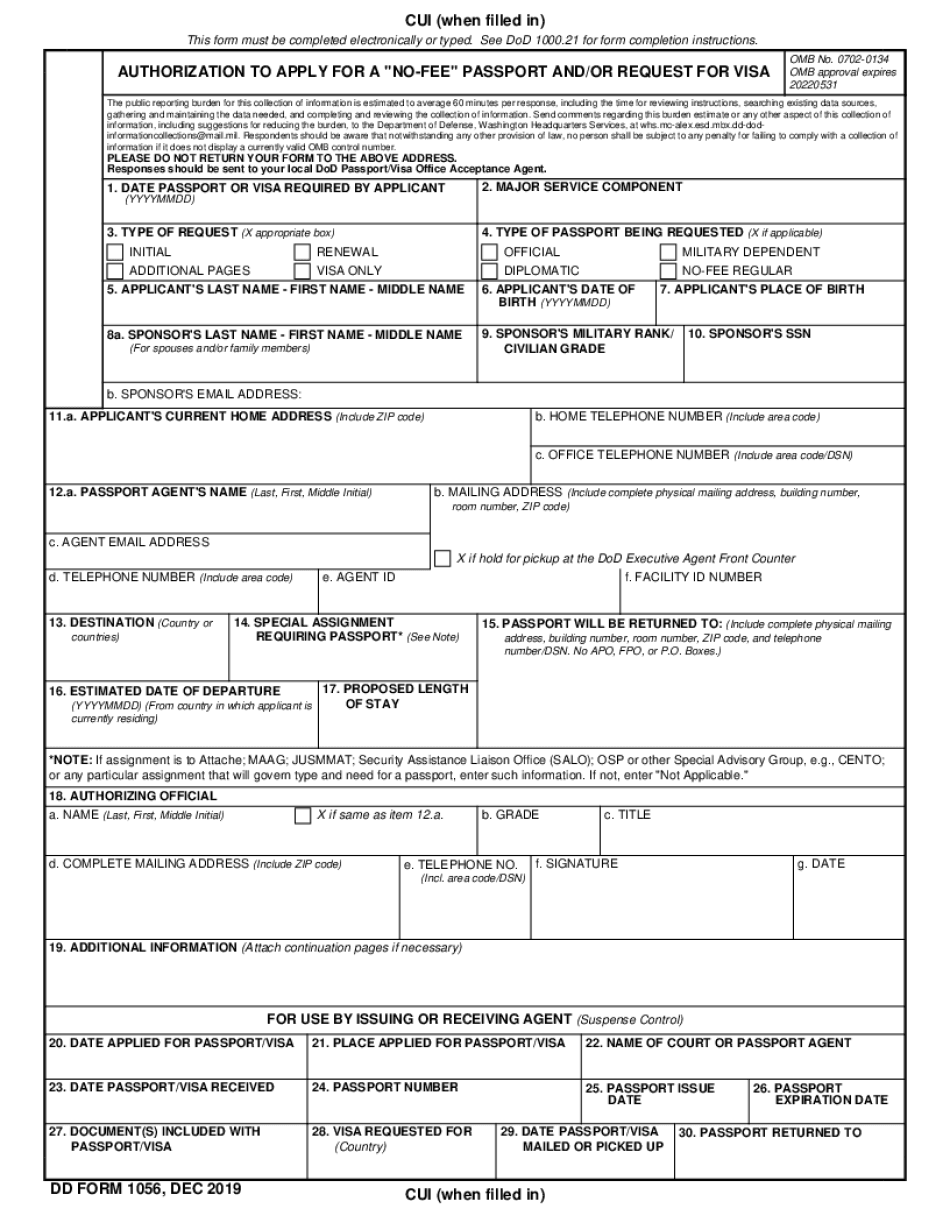

Dd 1056 2019-2025 Form: What You Should Know

Ix) Form DS-1644A, “Request for Visa Services”: and (x) Form DS-3350, “Request for Credit Report and Credit Report Access Services;”. 8 FAM 1203.2 RELEASE OF (1) Form 1040A (Certificate of Return by the Federal Government), Form 1040EZ (Certificate of Correction), and (2) Form 1040, Form 1041 or Form 1042 This sub-part discusses release of information about: (i) Form 1040 and Form 1040A (Certificate of Return); and (ii) Forms 1040EZ (Certificate of Correction) and DS-1640A (Request for Visa Service). If you are unsure whether you must request a certification, you should first verify that your taxpayer identification number (TIN) matches the information on Form 1040 and Form 1041 or the information on the correct return. If the information that you have in your hands does not match, you are not required to request a certification. Do not request a waiver unless the reason for the certification is a failure to meet income reporting requirements; an illegal disposition of property or an overpayment of taxes by the taxpayer or others; or an intentional tax evasion. (3) Forms 8379, 8379-A, 8479, and 8479-EZ (4) Reportable transaction statements (RT-1350), Form 943, and Statements 9 and 9-A (5) IRM 25.6.4, Form 1056 — Authorization To Apply for a No Fee Passport and/or Credit Report. (6) IRM Exhibit 8.5.4, Release of Taxpayer Information. (7) IRM 8.2.3.20, Identification of Taxpayer at Time of Submission for Application. (8) DoD Instruction 16.1.18.2, Identification of Passwords. (9) DoD Instruction 16.1.18.2, Identification of Taxpayer at Time of Submission for Application and/or Processing of Application. (10) DoD Instruction 16.1.18.2, Identification of Passwords, contains instructions on how to get this form online or from an office to your home.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Dd Form 1056, steer clear of blunders along with furnish it in a timely manner:

How to complete any Dd Form 1056 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Dd Form 1056 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Dd Form 1056 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.

Video instructions and help with filling out and completing Dd Form 1056 2019-2025