Award-winning PDF software

Dd 1056 may 2019-2025 fillable Form: What You Should Know

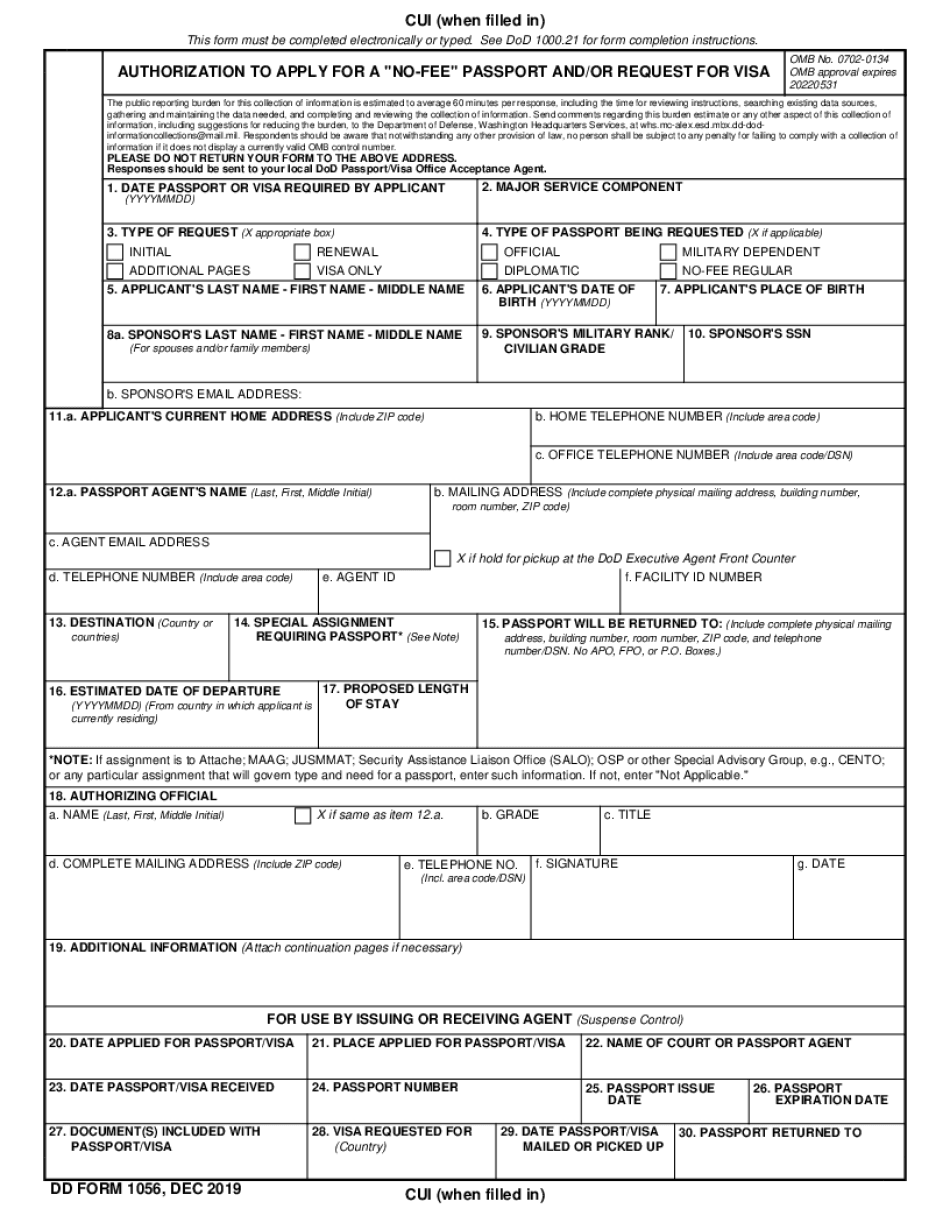

Travel with a passport no-fee at National Missions to the UN and other foreign diplomatic posts. Consequently, the DoD encourages all of your foreign travel documentation to be issued by the US Embassy or Consulate as you are responsible for obtaining them, without assistance. In addition to the documentation requirements of the State Department and Department of Homeland Security, the DD Form 1056 requires: Passport photo. A new passport (including photo page) must be obtained. Photocopy of the applicant's military ID. DD Form 1056 Application The DoD is authorized to issue a passport if the applicant was a US citizen on March 26, 2001. In accordance with section 102(a) of the National Defense Authorization Act for Fiscal Year 2025 (Pub. L. 114-92) (DOD Instruction 1000.21), DoD is hereby authorized to issue a non-immigrant B-1 nonimmigrant visa, or a nonimmigrant visa, to an applicant who possesses a valid US passport, and who (1) intends to travel, directly or by a close family member, outside the United States and its outlying areas for more than thirty days. The applicant must be a US citizen before application and not be inadmissible under any immigration law. (2) is a US citizen on March 26, 2001, and is under the age of 17 at the time of application. See also DoD Instruction 1055.06, titled: Application to Change Your Visa Status to B/M for Military Leave; and DoD Instruction 1055.06, titled: Renewal of Status to B/M for Military Leave (DD 1056) for more information. (i) The proposed application does not consist of a letter of application signed under penalty of perjury or any statement, affidavit, declaration, report, record, or other documentary evidence that the applicant is required to submit to establish eligibility for foreign travel documents as a result of the waiver, or because the Secretary of Defense has granted the waiver. (ii) Applicant does not have prior travel abroad, as determined under DoD Instruction 1055.05, entitled: Travel Outside the United States as a Military or Merchant Marine Officer; and DoD Instruction 1055.

Online solutions help you to manage your record administration along with raise the efficiency of the workflows. Stick to the fast guide to do Dd Form 1056, steer clear of blunders along with furnish it in a timely manner:

How to complete any Dd Form 1056 online: - On the site with all the document, click on Begin immediately along with complete for the editor.

- Use your indications to submit established track record areas.

- Add your own info and speak to data.

- Make sure that you enter correct details and numbers throughout suitable areas.

- Very carefully confirm the content of the form as well as grammar along with punctuational.

- Navigate to Support area when you have questions or perhaps handle our assistance team.

- Place an electronic digital unique in your Dd Form 1056 by using Sign Device.

- After the form is fully gone, media Completed.

- Deliver the particular prepared document by way of electronic mail or facsimile, art print it out or perhaps reduce the gadget.

PDF editor permits you to help make changes to your Dd Form 1056 from the internet connected gadget, personalize it based on your requirements, indicator this in electronic format and also disperse differently.